This post is kind abridged version [in our way] of first 15 chapters of Book - Kimball & Ross - The Data Warehouse Toolkit. We have tried to pull out main points from each chapters, however somewhere if you will out of context or doesn't get a link, we request you to go through a respective chapter once.

Chapter 1 : Dimensional Modeling Primer

Basic Elements of Data Warehouse

ODS

In either scenario, the ODS can be either a third physical system sitting between

the operational systems and the data warehouse or a specially administered hot

partition of the data warehouse itself. Every organization obviously needs

Dimensional Modeling Primer 15

operational systems. Likewise, every organization would benefit from a data

warehouse. The same cannot be said about a physically distinct ODS unless the

other two systems cannot answer your immediate operational questions.

Clearly, you shouldn’t allocate resources to construct a third physical system

unless your business needs cannot be supported by either the operational datacollection

system or the data warehouse. For these reasons, we believe that the

trend in data warehouse design is to deliver the ODS as a specially administered

portion of the conventional data warehouse.

Cube

If the presentation area is based on a relational database, then these dimensionally

modeled tables are referred to as star schemas. If the presentation area

is based on multidimensional database or online analytic processing (OLAP)

technology, then the data is stored in cubes. While the technology originally

wasn’t referred to as OLAP, many of the early decision support system vendors

built their systems around the cube concept, so today’s OLAP vendors

naturally are aligned with the dimensional approach to data warehousing.

Dimensional modeling is applicable to both relational and multidimensional

databases. Both have a common logical design with recognizable dimensions;

however, the physical implementation differs. Fortunately, most of the recommendations

in this book pertain, regardless of the database platform. While

the capabilities of OLAP technology are improving continuously, at the time of

this writing, most large data marts are still implemented on relational databases.

In addition, most OLAP cubes are sourced from or drill into relational

dimensional star schemas using a variation of aggregate navigation

Chapter 3 : Inventory

Semiadditive Facts

We stressed the importance of fact additivity in Chapter 2. When we modeled

the flow of product past a point at the checkout cash register, only the products

that actually sold were measured. Once a product was sold, it couldn’t be

counted again in a subsequent sale. This made most of the measures in the

retail sales schema perfectly additive across all dimensions.

In the inventory snapshot schema, the quantity on hand can be summarized

across products or stores and result in a valid total. Inventory levels, however,

are not additive across dates because they represent snapshots of a level or balance

at one point in time. It is not possible to tell whether yesterday’s inventory

is the same or different from today’s inventory solely by looking at

inventory levels. Because inventory levels (and all forms of financial account

balances) are additive across some dimensions but not all, we refer to them as

semiadditive facts.

The semiadditive nature of inventory balance facts is even more understandable

if we think about our checking account balances. On Monday, let’s presume

that you have $50 in your account. On Tuesday, the balance remains

unchanged. On Wednesday, you deposit another $50 into your account so that

the balance is now $100. The account has no further activity through the end of

the week. On Friday, you can’t merely add up the daily balances during the

week and declare that your balance is $400 (based on $50 + 50 + 100 + 100 +

100). The most useful way to combine account balances and inventory levels

across dates is to average them (resulting in an $80 average balance in the

checking example). We are all familiar with our bank referring to the average

daily balance on our monthly account summary.

All measures that record a static level (inventory levels, financial account balances,

and measures of intensity such as room temperatures) are inherently nonadditive

across the date dimension and possibly other dimensions. In these cases, the measure

may be aggregated usefully across time, for example, by averaging over the

number of time periods.

Drill Across

In Chapters 1 and 2 we modeled data from several processes of the value

chain. While separate fact tables in separate data marts represent the data from

each process, the models share several common business dimensions, namely,

date, product, and store. We’ve logically represented this dimension sharing in

Figure 3.6. Using shared, common dimensions is absolutely critical to designing

data marts that can be integrated. They allow us to combine performance

measurements from different processes in a single report. We use multipass

SQL to query each data mart separately, and then we outer join the query

results based on a common dimension attribute. This linkage, often referred to

as drill across, is straightforward if the dimension table attributes are identical

It is natural and common, especially for customer-oriented dimensions, for a dimension

to simultaneously support multiple independent hierarchies. The hierarchies

may have different numbers of levels. Drilling up and drilling down within each of

these hierarchies must be supported in a data warehouse.

The one-to-one or many-to-one relationship may turn out to be a many-tomany

relationship. As we discussed earlier, if the many-to-many relationship

is an exceptional condition, then we may still be tempted to combine

the sales rep attributes into the ship-to dimension, knowing that we’d need

to treat these rare many-to-many occurrences by issuing another surrogate

ship-to key.

If the relationship between sales rep and customer ship-to varies over time

or under the influence of a fourth dimension such as product, then the

combined dimension is in reality some kind of fact table itself! In this

case, we’d likely create separate dimensions for the sales rep and the customer

ship-to.

If the sales rep and customer ship-to dimensions participate independently

in other business process fact tables, we’d likely keep the dimensions

separate. Creating a single customer ship-to dimension with sales rep

attributes exclusively around orders data may make some of the other

Role Playing Dimension

Header and Line Item Facts with Different Granularity

It is quite common in parent-child transaction databases to encounter facts of differing

granularity. On an order, for example, there may be a shipping charge that

applies to the entire order that isn’t available at the individual product-level line

item in the operational system. The designer’s first response should be to try to

force all the facts down to the lowest level. We strive to flatten the parent-child

relationship so that all the rows are at the child level, including facts that are captured

operationally at the higher parent level, as illustrated in Figure 5.7. This procedure

is broadly referred to as allocating. Allocating the parent order facts to the

child line-item level is critical if we want the ability to slice and dice and roll up all

order facts by all dimensions, including product, which is a common requirement

As data is created on the operational side of the CRM equation, we obviously

need to store and analyze the historical metrics resulting from our customer

interaction and transaction systems. Sounds familiar, doesn’t it? The data

warehouse sits at the core of CRM. It serves as the repository to collect and

integrate the breadth of customer information found in our operational systems,

as well as from external sources. The data warehouse is the foundation

that supports the panoramic 360-degree view of our customers, including customer

data from the following typical sources: transactional data, interaction

data (solicitations, call center), demographic and behavioral data (typically

augmented by third parties), and self-provided profile data.

Analytic CRM is enabled via accurate, integrated, and accessible customer

data in the warehouse. We are able to measure the effectiveness of decisions

made in the past in order to optimize future interactions. Customer data can be

leveraged to better identify up-sell and cross-sell opportunities, pinpoint inefficiencies,

generate demand, and improve retention. In addition, we can leverage

the historical, integrated data to generate models or scores that close the

loop back to the operational world. Recalling the major components of a warehouse

environment from Chapter 1, we can envision the model results pushed

back to where the relationship is operationally managed (for example, sales

rep, call center, or Web site), as illustrated in Figure 6.1. The model output can

translate into specific proactive or reactive tactics recommended for the next

point of customer contact, such as the appropriate next product offer or antiattrition

response. The model results also are retained in the data warehouse for

subsequent analysis.

Obviously, as the organization becomes more centered on the customer, so

must the data warehouse. CRM inevitably will drive change in the data warehouse.

Data warehouses will grow even more rapidly as we collect more and

more information about our customers, especially from front-office sources

such as the field force. Our data staging processes will grow more complicated

as we match and integrate data from multiple sources. Most important, the

need for a conformed customer dimension becomes even more paramount.

Packaged CRM

In response to the urgent need of business for CRM, project teams may be

wrestling with a buy versus build decision. In the long run, the build approach

may match the organization’s requirements better than the packaged application,

but the implementation likely will take longer and require more

resources, potentially at a higher cost. Buying a packaged application will

deliver a practically ready-to-go solution, but it may not focus on the integration

and interface issues needed for it to function in the larger IT context. Fortunately,

some providers are supporting common data interchange through

Extensible Markup Language (XML), publishing their data specifications so

that IT can extract dimension and fact data, and supporting customer-specific

conformed dimensions.

Chapter 7 : Accounting

General Ledger Data

The general ledger (G/L) is a core foundation financial system because it ties

together the detailed information collected by the purchasing, payables (what

you owe to others), and receivables (what others owe you) subledgers or systems.

In this case study we’ll focus on the general ledger rather than the subledgers,

which would be handled as separate business processes and fact tables.

As we work through a basic design for G/L data, we discover, once again, that

two complementary schemas with periodic snapshot and transaction-grained

fact tables working together are required.

Financial analysts are constantly looking to streamline the processes for

period-end closing, reconciliation, and reporting of G/L results. While operational

G/L systems often support these requisite capabilities, they may be

cumbersome, especially if you’re not dealing with a modern G/L. In this chapter

we’ll focus on more easily analyzing the closed financial results rather than

facilitating the close. However, in many organizations, G/L trial balances are

loaded into the data warehouse to leverage the capabilities of the data warehouse’s

presentation area to find the needles in the G/L haystack and then

make the appropriate operational adjustments before the period ends.

The sample schema in Figure 7.1 supports the access and analysis of G/L

account balances at the end of each account period. It would be very useful for

many kinds of financial analysis, such as account rankings, trending patterns,

and period-to-period comparisons.

Chapter 8 : Human Resource Management

Time-Stamped Transaction Tracking in a Dimension

Thus far the dimensional models we have designed closely resemble each other

in that the fact tables have contained key performance metrics that typically can

be added across all the dimensions. It is easy for dimensional modelers to get

lulled into a kind of additive complacency. In most cases, this is exactly how it is

supposed to work. However, with HR employee data, many of the facts aren’t

additive. Most of the facts aren’t even numbers, yet they are changing all the time.

Factless Fact Table

Chapter 1 : Dimensional Modeling Primer

Basic Elements of Data Warehouse

ODS

In either scenario, the ODS can be either a third physical system sitting between

the operational systems and the data warehouse or a specially administered hot

partition of the data warehouse itself. Every organization obviously needs

Dimensional Modeling Primer 15

operational systems. Likewise, every organization would benefit from a data

warehouse. The same cannot be said about a physically distinct ODS unless the

other two systems cannot answer your immediate operational questions.

Clearly, you shouldn’t allocate resources to construct a third physical system

unless your business needs cannot be supported by either the operational datacollection

system or the data warehouse. For these reasons, we believe that the

trend in data warehouse design is to deliver the ODS as a specially administered

portion of the conventional data warehouse.

If the presentation area is based on a relational database, then these dimensionally

modeled tables are referred to as star schemas. If the presentation area

is based on multidimensional database or online analytic processing (OLAP)

technology, then the data is stored in cubes. While the technology originally

wasn’t referred to as OLAP, many of the early decision support system vendors

built their systems around the cube concept, so today’s OLAP vendors

naturally are aligned with the dimensional approach to data warehousing.

Dimensional modeling is applicable to both relational and multidimensional

databases. Both have a common logical design with recognizable dimensions;

however, the physical implementation differs. Fortunately, most of the recommendations

in this book pertain, regardless of the database platform. While

the capabilities of OLAP technology are improving continuously, at the time of

this writing, most large data marts are still implemented on relational databases.

In addition, most OLAP cubes are sourced from or drill into relational

dimensional star schemas using a variation of aggregate navigation

Facts

Additivity is crucial because data warehouse applications almost never

retrieve a single fact table row. Rather, they bring back hundreds, thousands,

or even millions of fact rows at a time, and the most useful thing to do with so

many rows is to add them up. In Figure 1.2, no matter what slice of the database

the user chooses, we can add up the quantities and dollars to a valid total.

We will see later in this book that there are facts that are semiadditive and still

others that are nonadditive. Semiadditive facts can be added only along some

of the dimensions, and nonadditive facts simply can’t be added at all. With

nonadditive facts we are forced to use counts or averages if we wish to summarize

the rows or are reduced to printing out the fact rows one at a time. This

would be a dull exercise in a fact table with a billion rows.

A row in a fact table corresponds to a measurement. A measurement is a row in a

fact table. All the measurements in a fact table must be at the same grain.

As we develop the examples in this book, we will see that all fact table grains

fall into one of three categories: transaction, periodic snapshot, and accumulating

snapshot. Transaction grain fact tables are among the most common

Snoflex Schema

Dimension tables often represent hierarchical relationships in the business. In

our sample product dimension table, products roll up into brands and then

into categories. For each row in the product dimension, we store the brand and

category description associated with each product. We realize that the hierarchical

descriptive information is stored redundantly, but we do so in the spirit

of ease of use and query performance. We resist our natural urge to store only

the brand code in the product dimension and create a separate brand lookup

table. This would be called a snowflake. Dimension tables typically are highly

denormalized.

Start Schema

Now that we understand fact and dimension tables, let’s bring the two building

blocks together in a dimensional model. As illustrated in Figure 1.4, the

fact table consisting of numeric measurements is joined to a set of dimension

tables filled with descriptive attributes. This characteristic starlike structure is

often called a star join schema. This term dates back to the earliest days of relational

databases.

Chapter 2 : Retail

Four-Step Dimensional Design Process

1. Select the business process to model.

2. Declare the grain of the business process.

3. Choose the dimensions that apply to each fact table row

Step 2. Declare the Grain

Once the business process has been identified, the data warehouse team faces

a serious decision about the granularity. What level of data detail should be

made available in the dimensional model? This brings us to an important

design tip.

Preferably you should develop dimensional models for the most atomic information

captured by a business process. Atomic data is the most detailed information collected;

such data cannot be subdivided further.

Why date dimentions are needed

Some designers pause at this point to ask why an explicit date dimension table

is needed. They reason that if the date key in the fact table is a date-type field,

then any SQL query can directly constrain on the fact table date key and use

natural SQL date semantics to filter on month or year while avoiding a supposedly

expensive join. This reasoning falls apart for several reasons. First of

all, if our relational database can’t handle an efficient join to the date dimension

table, we’re already in deep trouble. Most database optimizers are quite

efficient at resolving dimensional queries; it is not necessary to avoid joins like

the plague. Also, on the performance front, most databases don’t index SQL

date calculations, so queries constraining on an SQL-calculated field wouldn’t

take advantage of an index.

In terms of usability, the typical business user is not versed in SQL date semantics,

so he or she would be unable to directly leverage inherent capabilities

associated with a date data type. SQL date functions do not support filtering

by attributes such as weekdays versus weekends, holidays, fiscal periods, seasons,

or major events. Presuming that the business needs to slice data by these

nonstandard date attributes, then an explicit date dimension table is essential.

At the bottom line, calendar logic belongs in a dimension table, not in the

application code. Finally, we’re going to suggest that the date key is an integer

rather than a date data type anyway. An SQL-based date key typically is 8 bytes,

so you’re wasting 4 bytes in the fact table for every date key in every row. More

will be said on this later in this chapter.

Casual Dimension

Promotion Dimension

The promotion dimension is potentially the most interesting dimension in our

schema. The promotion dimension describes the promotion conditions under

which a product was sold. Promotion conditions include temporary price

reductions, end-aisle displays, newspaper ads, and coupons. This dimension

is often called a causal dimension (as opposed to a casual dimension) because

it describes factors thought to cause a change in product sales.

Null Values

Typically, many sales transaction line items involve products that are not being

promoted. We will need to include a row in the promotion dimension, with its

own unique key, to identify “No Promotion in Effect” and avoid a null promotion

key in the fact table. Referential integrity is violated if we put a null in a

fact table column declared as a foreign key to a dimension table. In addition to

the referential integrity alarms, null keys are the source of great confusion to

our users because they can’t join on null keys.

You must avoid null keys in the fact table. A proper design includes a row in the

corresponding dimension table to identify that the dimension is not applicable

to the measurement

NonAdditive Facts

Percentages and ratios, such as gross margin, are nonadditive. The numerator and

denominator should be stored in the fact table. The ratio can be calculated in a data

access tool for any slice of the fact table by remembering to calculate the ratio of

the sums, not the sum of the ratios

Unit price is also a nonadditive fact. Attempting to sum up unit price across any

of the dimensions results in a meaningless, nonsensical number

Product Dimension

An important function of the product master is to hold the many descriptive

attributes of each SKU. The merchandise hierarchy is an important group of

attributes. Typically, individual SKUs roll up to brands. Brands roll up to

categories, and categories roll up to departments. Each of these is a many-toone

relationship. This merchandise hierarchy and additional attributes are

detailed for a subset of products in Figure 2.6.

Drill Down

A reasonable product dimension table would have 50 or more descriptive

attributes. Each attribute is a rich source for constraining and constructing row

headers. Viewed in this manner, we see that drilling down is nothing more

than asking for a row header that provides more information. Let’s say we

have a simple report where we’ve summarized the sales dollar amount and

quantity by department.

If we want to drill down, we can drag virtually any other attribute, such as

brand, from the product dimension into the report next to department, and we

automatically drill down to this next level of detail. Atypical drill down within

the merchandise hierarchy would look like this:

We have belabored the examples of drilling down in order to make a point,

which we will express as a design principle.

Drilling down in a data mart is nothing more than adding row headers from the

dimension tables. Drilling up is removing row headers. We can drill down or up on

attributes from more than one explicit hierarchy and with attributes that are part of

no hierarchy.

Degenerate dimension

Although the POS transaction number looks like a dimension key in the fact

table, we have stripped off all the descriptive items that might otherwise fall in

a POS transaction dimension. Since the resulting dimension is empty, we refer

to the POS transaction number as a degenerate dimension (identified by the DD

notation in Figure 2.10). The natural operational ticket number, such as the

POS transaction number, sits by itself in the fact table without joining to a

dimension table. Degenerate dimensions are very common when the grain of

a fact table represents a single transaction or transaction line item because the

degenerate dimension represents the unique identifier of the parent. Order

numbers, invoice numbers, and bill-of-lading numbers almost always appear

as degenerate dimensions in a dimensional model.

Operational control numbers such as order numbers, invoice numbers, and bill-oflading

numbers usually give rise to empty dimensions and are represented as degenerate

dimensions (that is, dimension keys without corresponding dimension tables)

in fact tables where the grain of the table is the document itself or a line item in the

document.

Factless Fact table

Promotion Coverage Factless Fact Table

Regardless of the handling of the promotion dimension, there is one important

question that cannot be answered by our retail sales schema: What products

were on promotion but did not sell? The sales fact table only records the SKUs

actually sold. There are no fact table rows with zero facts for SKUs that didn’t

sell because doing so would enlarge the fact table enormously. In the relational

world, a second promotion coverage or event fact table is needed to help

answer the question concerning what didn’t happen. The promotion coverage

fact table keys would be date, product, store, and promotion in our case study.

This obviously looks similar to the sales fact table we just designed; however,

the grain would be significantly different. In the case of the promotion coverage

fact table, we’d load one row in the fact table for each product on promotion

in a store each day (or week, since many retail promotions are a week in

duration) regardless of whether the product sold or not. The coverage fact

table allows us to see the relationship between the keys as defined by a promotion,

independent of other events, such as actual product sales. We refer to

it as a factless fact table because it has no measurement metrics; it merely captures

the relationship between the involved keys. To determine what products

where on promotion but didn’t sell requires a two-step process. First, we’d

query the promotion coverage table to determine the universe of products that

were on promotion on a given day. We’d then determine what products sold

from the POS sales fact table. The answer to our original question is the set difference

between these two lists of products.

Snlowflaking

Dimension table normalization typically is referred to as snowflaking

The dimension tables should remain as flat tables physically. Normalized,

snowflaked dimension tables penalize cross-attribute browsing and prohibit the use

of bit-mapped indexes. Disk space savings gained by normalizing the dimension tables

typically are less than 1 percent of the total disk space needed for the overall

schema. We knowingly sacrifice this dimension table space in the spirit of performance

and ease-of-use advantages.

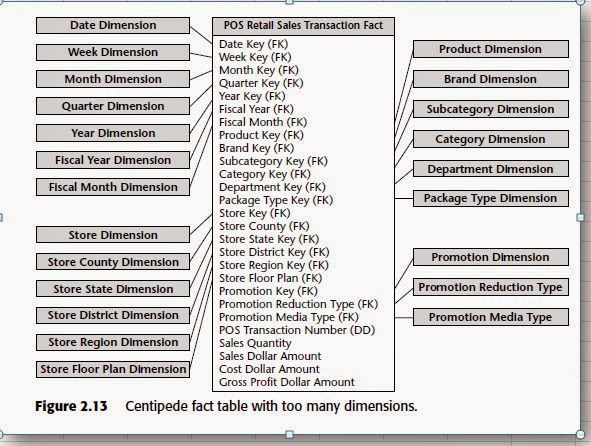

Centipede fact

Most business processes can be represented with less than 15 dimensions in

the fact table. If our design has 25 or more dimensions, we should look for

ways to combine correlated dimensions into a single dimension. Perfectly correlated

attributes, such as the levels of a hierarchy, as well as attributes with a

reasonable statistical correlation, should be part of the same dimension. You

have made a good decision to combine dimensions when the resulting new

single dimension is noticeably smaller than the Cartesian product of the separate

dimensions.

Chapter 3 : Inventory

Semiadditive Facts

We stressed the importance of fact additivity in Chapter 2. When we modeled

the flow of product past a point at the checkout cash register, only the products

that actually sold were measured. Once a product was sold, it couldn’t be

counted again in a subsequent sale. This made most of the measures in the

retail sales schema perfectly additive across all dimensions.

In the inventory snapshot schema, the quantity on hand can be summarized

across products or stores and result in a valid total. Inventory levels, however,

are not additive across dates because they represent snapshots of a level or balance

at one point in time. It is not possible to tell whether yesterday’s inventory

is the same or different from today’s inventory solely by looking at

inventory levels. Because inventory levels (and all forms of financial account

balances) are additive across some dimensions but not all, we refer to them as

semiadditive facts.

The semiadditive nature of inventory balance facts is even more understandable

if we think about our checking account balances. On Monday, let’s presume

that you have $50 in your account. On Tuesday, the balance remains

unchanged. On Wednesday, you deposit another $50 into your account so that

the balance is now $100. The account has no further activity through the end of

the week. On Friday, you can’t merely add up the daily balances during the

week and declare that your balance is $400 (based on $50 + 50 + 100 + 100 +

100). The most useful way to combine account balances and inventory levels

across dates is to average them (resulting in an $80 average balance in the

checking example). We are all familiar with our bank referring to the average

daily balance on our monthly account summary.

All measures that record a static level (inventory levels, financial account balances,

and measures of intensity such as room temperatures) are inherently nonadditive

across the date dimension and possibly other dimensions. In these cases, the measure

may be aggregated usefully across time, for example, by averaging over the

number of time periods.

Drill Across

In Chapters 1 and 2 we modeled data from several processes of the value

chain. While separate fact tables in separate data marts represent the data from

each process, the models share several common business dimensions, namely,

date, product, and store. We’ve logically represented this dimension sharing in

Figure 3.6. Using shared, common dimensions is absolutely critical to designing

data marts that can be integrated. They allow us to combine performance

measurements from different processes in a single report. We use multipass

SQL to query each data mart separately, and then we outer join the query

results based on a common dimension attribute. This linkage, often referred to

as drill across, is straightforward if the dimension table attributes are identical

Buss Architecture

The word bus is an old term from the electrical power industry that is now

used commonly in the computer industry. A bus is a common structure to

which everything connects and from which everything derives power. The bus

in your computer is a standard interface specification that allows you to plug

in a disk drive, CD-ROM, or any number of other specialized cards or devices.

Because of the computer’s bus standard, these peripheral devices work

together and usefully coexist, even though they were manufactured at different

times by different vendors.

By defining a standard bus interface for the data warehouse environment, separate

data marts can be implemented by different groups at different times. The separate

data marts can be plugged together and usefully coexist if they adhere to the standard

The bus architecture is independent of technology and the database platform.

All flavors of relational and online analytical processing (OLAP)-based data

marts can be full participants in the data warehouse bus if they are designed

around conformed dimensions and facts. Data warehouses will inevitably

consist of numerous separate machines with different operating systems and

database management systems (DBMSs). If designed coherently, they will

share a uniform architecture of conformed dimensions and facts that will

allow them to be fused into an integrated whole.

The major responsibility of the centralized dimension authority is to establish, maintain,

and publish the conformed dimensions to all the client data marts.

gross margin return on inventory (GMROI,pronounced “jem-roy”)

Although this formula looks complicated, the idea behind GMROI is simple. By

multiplying the gross margin by the number of turns, we create a measure of the

effectiveness of our inventory investment. A high GMROI means that we are

moving the product through the store quickly (lots of turns) and are making

good money on the sale of the product (high gross margin). Alow GMROI means

that we are moving the product slowly (low turns) and aren’t making very much

money on it (low gross margin). The GMROI is a standard metric used by inventory

analysts to judge a company’s quality of investment in its inventory.

If we want to be more ambitious than our initial design in Figure 3.2, then we

should include the quantity sold, value at cost, and value at the latest selling

price columns in our snapshot fact table, as illustrated in Figure 3.3. Of course,

if some of these metrics exist at different granularity in separate fact tables, a

requesting application would need to retrieve all the components of the

GMROI computation at the same level.

Notice that quantity on hand is semiadditive but that the other measures in

our advanced periodic snapshot are all fully additive across all three dimensions.

The quantity sold amount is summarized to the particular grain of the

fact table, which is daily in this case. The value columns are extended, additive

amounts. We do not store GMROI in the fact table because it is not additive.

We can calculate GMROI from the constituent columns across any number of

fact rows by adding the columns up before performing the calculation, but we

are dead in the water if we try to store GMROI explicitly because we can’t usefully

combine GMROIs across multiple rows.

Remember that there’s more to life than transactions alone. Some form of snapshot

table to give a more cumulative view of a process often accompanies a transaction

fact table.

Let’s assume that the inventory goes through a series of well-defined events or

milestones as it moves through the warehouse, such as receiving, inspection,

bin placement, authorization to sell, picking, boxing, and shipping. The philosophy

behind the accumulating snapshot fact table is to provide an updated

status of the product shipment as it moves through these milestones. Each fact

table row will be updated until the product leaves the warehouse. As illustrated

in Figure 3.5, the inventory accumulating snapshot fact table with its

multitude of dates and facts looks quite different from the transaction or periodic

snapshot schemas.

The rows of the bus matrix correspond to data marts. You should create separate

matrix rows if the sources are different, the processes are different, or if the matrix

row represents more than what can reasonably be tackled in a single implementation

iteration.

Creating the data warehouse bus matrix is one of the most important up-front deliverables

of a data warehouse implementation. It is a hybrid resource that is part technical

design tool, part project management tool, and part communication tool.

It goes without saying that it is unacceptable to build separate data marts that

ignore a framework to tie the data together. Isolated, independent data marts

are worse than simply a lost opportunity for analysis. They deliver access to

irreconcilable views of the organization and further enshrine the reports that

cannot be compared with one another. Independent data marts become legacy

implementations in their own right; by their very existence, they block the

development of a coherent warehouse environment.

Conformed Fact

Revenue, profit, standard prices, standard costs, measures of quality, measures

of customer satisfaction, and other key performance indicators (KPIs) are facts

that must be conformed. In general, fact table data is not duplicated explicitly

in multiple data marts. However, if facts do live in more than one location,

such as in first-level and consolidated marts, the underlying definitions and

equations for these facts must be the same if they are to be called the same

thing. If they are labeled identically, then they need to be defined in the same

dimensional context and with the same units of measure from data mart to

data mart.

Chapter 4 : Procruments

Type 1: Overwrite the Value

With the type 1 response, we merely overwrite the old attribute value in the

dimension row, replacing it with the current value. In so doing, the attribute

always reflects the most recent assignment.

The type 1 response is easy to implement, but it does not maintain any history of

prior attribute values.

Before we leave the topic of type 1 changes, there’s one more easily overlooked

catch that you should be aware of. When we used a type 1 response to deal

with the relocation of IntelliKidz, any preexisting aggregations based on the

department value will need to be rebuilt. The aggregated data must continue

to tie to the detailed atomic data, where it now appears that IntelliKidz has

always rolled up into the Strategy department.

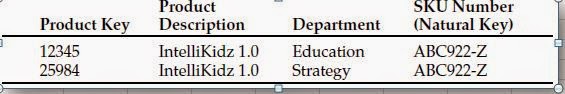

Type 2: Add a Dimension Row

We made the claim earlier in this book that one of the primary goals of the data

warehouse was to represent prior history correctly. A type 2 response is the

predominant technique for supporting this requirement when it comes to

slowly changing dimensions.

Using the type 2 approach, when IntelliKidz’s department changed, we issue

a new product dimension row for IntelliKidz to reflect the new department

attribute value. We then would have two product dimension rows for IntelliKidz,

such as the following:

Now we see why the product dimension key can’t be the SKU number natural

key. We need two different product surrogate keys for the same SKU or physical

barcode. Each of the separate surrogate keys identifies a unique product

attribute profile that was true for a span of time. With type 2 changes, the fact

table is again untouched. We don’t go back to the historical fact table rows to

modify the product key.

If we constrain only on the department attribute, then we very precisely differentiate

between the two product profiles. If we constrain only on the product

description, that is, IntelliKidz 1.0, then the query automatically will fetch

both IntelliKidz product dimension rows and automatically join to the fact

table for the complete product history. If we need to count the number of products

correctly, then we would just use the SKU natural key attribute as the

basis of the distinct count rather than the surrogate key. The natural key field

becomes a kind of reliable glue that holds the separate type 2 records for a single

product together. Alternatively, a most recent row indicator might be

another useful dimension attribute to allow users to quickly constrain their

query to only the current profiles.

Since the type 2 technique spawns new dimension rows, one downside of this

approach is accelerated dimension table growth. Hence it may be an inappropriate

technique for dimension tables that already exceed a million rows.

Type 3: Add a Dimension Column

In our software example, let’s assume that there is a legitimate business need

to track both the old and new values of the department attribute both forward

and backward for a period of time around the change. With a type 3 response,

we do not issue a new dimension row, but rather we add a new column to capture

the attribute change. In the case of IntelliKidz, we alter the product

dimension table to add a prior department attribute. We populate this new column

with the existing department value (Education). We then treat the department

attribute as a type 1 response, where we overwrite to reflect the current

value (Strategy). All existing reports and queries switch over to the new

department description immediately, but we can still report on the old department

value by querying on the prior department attribute.

The type 3 slowly changing dimension technique allows us to see new and historical

fact data by either the new or prior attribute values

Atype 3 response is inappropriate if you want to track the impact of numerous

intermediate attribute values.

Hybrid Slowly Changing Dimension Techniques

Each sales rep dimension row would include all prior district assignments.

The business user could choose to roll up the sales facts with any of the five

district maps. If a sales rep were hired in 2000, the dimension attributes for

1998 and 1999 would contain values along the lines of “Not Applicable.”

We label the most recent assignment as “Current District.” This attribute will

be used most frequently; we don’t want to modify our existing queries and

reports to accommodate next year’s change. When the districts are redrawn

next, we’d alter the table to add a district 2002 attribute. We’d populate this

column with the current district values and then overwrite the current

attribute with the 2003 district assignments.

In this manner we’re able to use the historical attribute to segment history and

see facts according to the departmental roll-up at that point in time. Meanwhile,

the current attribute rolls up all the historical fact data for product keys

12345 and 25984 into the current department assignment. If IntelliKidz were

then moved into the Critical Thinking software department, our product table

would look like the following:

With this hybrid approach, we issue a new row to capture the change (type

2) and add a new column to track the current assignment (type 3), where

subsequent changes are handled as a type 1 response. Someone once suggested

that we refer to this combo approach as type 6 (2 + 3 + 1). This technique

allows us to track the historical changes accurately while also

supporting the ability to roll up history based on the current assignments.

We could further embellish (and complicate) this strategy by supporting

additional static department roll-up structures, in addition to the current

department, as separate attributes.

More Rapidly Changing Dimensions

In this chapter we’ve focused on the typically rather slow, evolutionary

changes to our dimension tables. What happens, however, when the rate of

change speeds up? If a dimension attribute changes monthly, then we’re no

longer dealing with a slowly changing dimension that can be handled reasonably

with the techniques just discussed. One powerful approach for handling

more rapidly changing dimensions is to break off these rapidly changing

attributes into one or more separate dimensions. In our fact table we would

then have two foreign keys—one for the primary dimension table and another

for the rapidly changing attribute(s). These dimension tables would be associated

with one another every time we put a row in the fact table.

Chapter 5 : Order Management

Order management consists of several critical business processes, including

order, shipment, and invoice processing. These processes spawn important

business metrics, such as sales volume and invoice revenue, that are key performance

indicators for any organization that sells products or services to

others.

It is natural and common, especially for customer-oriented dimensions, for a dimension

to simultaneously support multiple independent hierarchies. The hierarchies

may have different numbers of levels. Drilling up and drilling down within each of

these hierarchies must be supported in a data warehouse.

The one-to-one or many-to-one relationship may turn out to be a many-tomany

relationship. As we discussed earlier, if the many-to-many relationship

is an exceptional condition, then we may still be tempted to combine

the sales rep attributes into the ship-to dimension, knowing that we’d need

to treat these rare many-to-many occurrences by issuing another surrogate

ship-to key.

If the relationship between sales rep and customer ship-to varies over time

or under the influence of a fourth dimension such as product, then the

combined dimension is in reality some kind of fact table itself! In this

case, we’d likely create separate dimensions for the sales rep and the customer

ship-to.

If the sales rep and customer ship-to dimensions participate independently

in other business process fact tables, we’d likely keep the dimensions

separate. Creating a single customer ship-to dimension with sales rep

attributes exclusively around orders data may make some of the other

Role Playing Dimension

Role-playing in a data warehouse occurs when a single dimension simultaneously

appears several times in the same fact table. The underlying dimension may exist as

a single physical table, but each of the roles should be presented to the data access

tools in a separately labeled view.

Deal Dimension

The deal dimension is similar to the promotion dimension from Chapter 2. The

deal dimension describes the incentives that have been offered to the customer

that theoretically affect the customers’ desire to purchase products. This

dimension is also sometimes referred to as the contract. As shown in Figure 5.4,

the deal dimension describes the full combination of terms, allowances, and

incentives that pertain to the particular order line item.

Degenerate Dimension for Order Number

The deal dimension is similar to the promotion dimension from Chapter 2. The

deal dimension describes the incentives that have been offered to the customer

that theoretically affect the customers’ desire to purchase products. This

dimension is also sometimes referred to as the contract. As shown in Figure 5.4,

the deal dimension describes the full combination of terms, allowances, and

incentives that pertain to the particular order line item.

Degenerate Dimension for Order Number

Each line item row in the orders fact table includes the order number as a

degenerate dimension, as we introduced in Chapter 2. Unlike a transactional

parent-child database, the order number in our dimensional models is not tied

to an order header table. We have stripped all the interesting details from the

order header into separate dimensions such as the order date, customer ship-to,

and other interesting fields. The order number is still useful because it allows us

to group the separate line items on the order. It enables us to answer such questions

as the average number of line items on an order. In addition, the order

number is used occasionally to link the data warehouse back to the operational

world. Since the order number is left sitting by itself in the fact table without

joining to a dimension table, it is referred to as a degenerate dimension.

Degenerate dimensions typically are reserved for operational transaction identifiers.

They should not be used as an excuse to stick a cryptic code in the fact table without

joining to a descriptive decode in a dimension table.

Junk Dimensions

When we’re confronted with a complex operational data source, we typically

perform triage to quickly identify fields that are obviously related to dimensions,

such as date stamps or attributes. We then identify the numeric measurements

in the source data. At this point, we are often left with a number of

miscellaneous indicators and flags, each of which takes on a small range of discrete

values. The designer is faced with several rather unappealing options,

including:

Leave the flags and indicators unchanged in the fact table row. This could

cause the fact table row to swell alarmingly. It would be a shame to create a

nice tight dimensional design with five dimensions and five facts and then

leave a handful of uncompressed textual indicator columns in the row

Make each flag and indicator into its own separate dimension. Doing so

could cause our 5-dimension design to balloon into a 25-dimension design.

Strip out all the flags and indicators from the design. Of course, we ask the

obligatory question about removing these miscellaneous flags because they

seem rather insignificant, but this notion is often vetoed quickly because

someone might need them. It is worthwhile to examine this question carefully.

If the indicators are incomprehensible, noisy, inconsistently populated,

or only of operational significance, they should be left out

An appropriate approach for tackling these flags and indicators is to study

them carefully and then pack them into one or more junk dimensions.

A junk dimension is a convenient grouping of typically low-cardinality flags and indicators.

By creating an abstract dimension, we remove the flags from the fact table

while placing them into a useful dimensional framework.

We’ve illustrated sample rows from an order indicator dimension in Figure 5.5. A

subtle issue regarding junk dimensions is whether you create rows for all the

combinations beforehand or create junk dimension rows for the combinations as

you actually encounter them in the data. The answer depends on how many possible

combinations you expect and what the maximum number could be. Generally,

when the number of theoretical combinations is very high and you don’t

think you will encounter them all, you should build a junk dimension row at

extract time whenever you encounter a new combination of flags or indicators

It is quite common in parent-child transaction databases to encounter facts of differing

granularity. On an order, for example, there may be a shipping charge that

applies to the entire order that isn’t available at the individual product-level line

item in the operational system. The designer’s first response should be to try to

force all the facts down to the lowest level. We strive to flatten the parent-child

relationship so that all the rows are at the child level, including facts that are captured

operationally at the higher parent level, as illustrated in Figure 5.7. This procedure

is broadly referred to as allocating. Allocating the parent order facts to the

child line-item level is critical if we want the ability to slice and dice and roll up all

order facts by all dimensions, including product, which is a common requirement

We shouldn’t mix fact granularities (for example, order and order line facts) within a

single fact table. Instead, we need to either allocate the higher-level facts to a more

detailed level or create two separate fact tables to handle the differently grained

facts. Allocation is the preferred approach. Optimally, a finance or business team

(not the data warehouse team) spearheads the allocation effort.

Invoice Transaction

In the shipment invoice fact table we can see all the company’s products, all

the customers, all the contracts and deals, all the off-invoice discounts and

allowances, all the revenue generated by customers purchasing products, all

the variable and fixed costs associated with manufacturing and delivering

products (if available), all the money left over after delivery of product (contribution),

and customer satisfaction metrics such as on-time shipment.

For any company that ships products to customers or bills customers for services rendered,

the optimal place to start a data warehouse typically is with invoices. We often

refer to the data resulting from invoicing as the most powerful database because it

combines the company’s customers, products, and components of profitability.

Extended gross invoice amount. This is also know as extended list price

because it is the quantity shipped multiplied by the list unit price.

Extended allowance amount. This is the amount subtracted from the

invoice-line gross amount for deal-related allowances. The allowances are

described in the adjoined deal dimension. The allowance amount is often

called an off-invoice allowance

Extended discount amount. This is the amount subtracted on the invoice for

volume or payment-term discounts. The explanation of which discounts

are taken is also found in the deal dimension row that points to this fact

table row

All allowances and discounts in this fact table are represented at the line

item level. As we discussed earlier, some allowances and discounts may be

calculated operationally at the invoice level, not the line-item level. An

effort should be made to allocate them down to the line item. An invoice

P&L statement that does not include the product dimension poses a serious

limitation on our ability to present meaningful P&L slices of the business.

Extended net invoice amount. This is the amount the customer is expected to

pay for this line item before tax. It is equal to the gross invoice amount less

the allowances and discounts.

However, there are times when users are more interested in analyzing the

entire order fulfillment pipeline. They want to better understand product

velocity, or how quickly products move through the pipeline. The accumulating

snapshot fact table provides us with this perspective of the business, as

illustrated in Figure 5.10. It allows us to see an updated status and ultimately

the final disposition of each order

The accumulating snapshot complements our alternative perspectives of the

pipeline. If we’re interested in understanding the amount of product flowing

through the pipeline, such as the quantity ordered, produced, or shipped, we rely

on transaction schemas that monitor each of the pipeline’s major spigots. Periodic

snapshots give us insight into the amount of product sitting in the pipeline, such

as the backorder or finished goods inventories, or the amount of product flowing

through a spigot during a predefined time period. The accumulating snapshot

helps us better understand the current state of an order, as well as product movement

velocities to identify pipeline bottlenecks and inefficiencies.

We notice immediately that the accumulating snapshot looks different from

the other fact tables we’ve designed thus far. The reuse of conformed dimensions

is to be expected, but the number of date and fact columns is larger than

we’ve seen in the past. We capture a large number of dates and facts as the

order progresses through the pipeline. Each date represents a major milestone

of the fulfillment pipeline. We handle each of these dates as dimension roles by

creating either physically distinct tables or logically distinct views. It is critical

that a surrogate key is used for these date dimensions rather than a literal SQL

date stamp because many of the fact table date fields will be “Unknown” or

“To be determined” when we first load the row. Obviously, we don’t need to

declare all the date fields in the fact table’s primary key.

The fundamental difference between accumulating snapshots and other fact

tables is the notion that we revisit and update existing fact table rows as more

information becomes available. The grain of an accumulating snapshot fact

table is one row per the lowest level of detail captured as the pipeline is

entered. In our example, the grain would equal one row per order line item.

However, unlike the order transaction fact table we designed earlier with the

same granularity, the fact table row in the accumulating snapshot is modified

while the order moves through the pipeline as more information is collected

from every stage of the lifecycle.

Accumulating snapshots typically have multiple dates in the fact table representing the

major milestones of the process. However, just because a fact table has several dates

doesn’t dictate that it is an accumulating snapshot. The primary differentiator of an accumulating

snapshot is that we typically revisit the fact rows as activity takes place

Packaging all the facts and conversion factors together in the same fact table row

provides the safest guarantee that these factors will be used correctly. The converted

facts are presented in a view(s) to the users.

Beyond the Rear-View Mirror

Much of what we’ve discussed in this chapter focuses on effective ways to

analyze historical product movement performance. People sometimes refer to

these as rear-view mirror metrics because they allow us to look backward and

see where we’ve been.

Transaction Grain Real-Time Partition

If the static data warehouse fact table has a transaction grain, then it contains

exactly one record for each individual transaction in the source system from

the beginning of recorded history. If no activity occurs in a time period, there

are no transaction records. Conversely, there can be a blizzard of closely

related transaction records if the activity level is high. The real-time partition

has exactly the same dimensional structure as its underlying static fact table. It

only contains the transactions that have occurred since midnight, when we

loaded the regular data warehouse tables. The real-time partition may be completely

unindexed both because we need to maintain a continuously open

window for loading and because there is no time series (since we only keep

today’s data in this table). Finally, we avoid building aggregates on this table

because we want a minimalist administrative scenario during the day.

We attach the real-time partition to our existing applications by drilling across

from the static fact table to the real-time partition. Time-series aggregations

(for example, all sales for the current month) will need to send identical

queries to the two fact tables and add them together.

Forget indexes, except

for a B-Tree index on the fact table primary key to facilitate the most efficient

loading. Forget aggregations too. Our real-time partition can remain biased

toward very fast loading performance but at the same time provide speedy

query performance.

Periodic Snapshot Real-Time Partition

If the static data warehouse fact table has a periodic grain (say, monthly), then

the real-time partition can be viewed as the current hot-rolling month. Suppose

that we are working for a big retail bank with 15 million accounts. The static fact

table has the grain of account by month. A36-month time series would result in

540 million fact table records. Again, this table would be indexed extensively

and supported by aggregates to provide good query performance. The real-time

partition, on the other hand, is just an image of the current developing month,

updated continuously as the month progresses. Semiadditive balances and fully

additive facts are adjusted as frequently as they are reported. In a retail bank, the

core fact table spanning all account types is likely to be quite narrow, with perhaps

4 dimensions and 4 facts, resulting in a real-time partition of 480 MB. The

real-time partition again can be pinned in memory.

Accumulating Snapshot Real-Time Partition

Accumulating snapshots are used for short-lived processes such as orders and

shipments. A record is created for each line item on the order or shipment. In

the main fact table this record is updated repeatedly as activity occurs. We create

the record for a line item when the order is first placed, and then we update

it whenever the item is shipped, delivered to the final destination, paid for, or

maybe returned. Accumulating snapshot fact tables have a characteristic set of

date foreign keys corresponding to each of these steps

Queries against an accumulating snapshot with a real-time partition need to

fetch the appropriate line items from both the main fact table and the partition

and can either drill across the two tables by performing a sort merge (outer

join) on the identical row headers or perform a union of the rows from the two

tables, presenting the static view augmented with occasional supplemental

rows in the report representing today’s hot activity.

In this section we have made a case for satisfying the new real-time requirement

with specially constructed but nevertheless familiar extensions to our

existing fact tables. If you drop all the indexes (except for a basic B-Tree index

for updating) and aggregations on these special new tables and pin them in

memory, you should be able to get the combined update and query performance

needed.

Chapter 6 : Customer Relationship Management

need to store and analyze the historical metrics resulting from our customer

interaction and transaction systems. Sounds familiar, doesn’t it? The data

warehouse sits at the core of CRM. It serves as the repository to collect and

integrate the breadth of customer information found in our operational systems,

as well as from external sources. The data warehouse is the foundation

that supports the panoramic 360-degree view of our customers, including customer

data from the following typical sources: transactional data, interaction

data (solicitations, call center), demographic and behavioral data (typically

augmented by third parties), and self-provided profile data.

Analytic CRM is enabled via accurate, integrated, and accessible customer

data in the warehouse. We are able to measure the effectiveness of decisions

made in the past in order to optimize future interactions. Customer data can be

leveraged to better identify up-sell and cross-sell opportunities, pinpoint inefficiencies,

generate demand, and improve retention. In addition, we can leverage

the historical, integrated data to generate models or scores that close the

loop back to the operational world. Recalling the major components of a warehouse

environment from Chapter 1, we can envision the model results pushed

back to where the relationship is operationally managed (for example, sales

rep, call center, or Web site), as illustrated in Figure 6.1. The model output can

translate into specific proactive or reactive tactics recommended for the next

point of customer contact, such as the appropriate next product offer or antiattrition

response. The model results also are retained in the data warehouse for

subsequent analysis.

must the data warehouse. CRM inevitably will drive change in the data warehouse.

Data warehouses will grow even more rapidly as we collect more and

more information about our customers, especially from front-office sources

such as the field force. Our data staging processes will grow more complicated

as we match and integrate data from multiple sources. Most important, the

need for a conformed customer dimension becomes even more paramount.

Packaged CRM

In response to the urgent need of business for CRM, project teams may be

wrestling with a buy versus build decision. In the long run, the build approach

may match the organization’s requirements better than the packaged application,

but the implementation likely will take longer and require more

resources, potentially at a higher cost. Buying a packaged application will

deliver a practically ready-to-go solution, but it may not focus on the integration

and interface issues needed for it to function in the larger IT context. Fortunately,

some providers are supporting common data interchange through

Extensible Markup Language (XML), publishing their data specifications so

that IT can extract dimension and fact data, and supporting customer-specific

conformed dimensions.

Customer Dimension

The conformed customer dimension is a critical element for effective CRM. A

well-maintained, well-deployed conforming customer dimension is the cornerstone

of sound customer-centric analysis.

The customer dimension is typically the most challenging dimension for any

data warehouse. In a large organization, the customer dimension can be

extremely deep (with millions of rows), extremely wide (with dozens or even

hundreds of attributes), and sometimes subject to rather rapid change. One

leading direct marketer maintains over 3,000 attributes about its customers.

Any organization that deals with the general public needs an individual

human being dimension. The biggest retailers, credit card companies, and

government agencies have monster customer dimensions whose sizes exceed

100 million rows. To further complicate matters, the customer dimension often

represents an amalgamation of data from multiple internal and external source

systems.

Dimension Outrigger

Dimension Outriggers for a Low-Cardinality Attribute Set

As we said in Chapter 2, a dimension is said to be snowflaked when the low-cardinality

columns in the dimension have been removed to separate normalized

tables that then link back into the original dimension table. Generally,

snowflaking is not recommended in a data warehouse environment because it

almost always makes the user presentation more complex, in addition to having

a negative impact on browsing performance. Despite this prohibition

against snowflaking, there are some situations where you should build a

dimension outrigger that has the appearance of a snowflaked table. Outriggers

have special characteristics that cause them to be permissible snowflakes.

In Figure 6.3, the dimension outrigger is a set of data from an external data

provider consisting of 150 demographic and socioeconomic attributes regarding

the customers’ county of residence. The data for all customers residing in a given

county is identical. Rather than repeating this large block of data for every customer

within a county, we opt to model it as an outrigger. There are several factors

that cause us to bend our no-snowflake rule. First of all, the demographic

data is available at a significantly different grain than the primary dimension

data (county versus individual customer). The data is administered and loaded

at different times than the rest of the data in the customer dimension. Also, we

really do save significant space in this case if the underlying customer dimension

is large. If you have a query tool that insists on a classic star schema with no

snowflakes, you can hide the outrigger under a view declaration.

Dimension outriggers are permissible, but they should be the exception rather than

the rule. A red warning flag should go up if your design is riddled with outriggers;

you may have succumbed to the temptation to overly normalize the design.

Large Changing Customer Dimensions

Multimillion-row customer dimensions present two unique challenges that

warrant special treatment. Even if a clean, flat dimension table has been implemented,

it generally takes too long to constrain or browse among the relationships

in such a big table. In addition, it is difficult to use our tried-and-true

techniques from Chapter 4 for tracking changes in these large dimensions. We

probably don’t want to use the type 2 slowly changing dimension technique

and add more rows to a customer dimension that already has millions of rows

in it. Unfortunately, huge customer dimensions are even more likely to change

than moderately sized dimensions. We sometimes call this situation a rapidly

changing monster dimension!

minidimension

Business users often want to track the myriad of customer attribute changes.

In some businesses, tracking change is not merely a nice-to-have analytic capability.

Insurance companies, for example, must update information about their

customers and their specific insured automobiles or homes because it is critical

to have an accurate picture of these dimensions when a policy is approved

or claim is made.

Fortunately, a single technique comes to the rescue to address both the browsing-

performance and change-tracking challenges. The solution is to break off

frequently analyzed or frequently changing attributes into a separate dimension,

referred to as a minidimension. For example, we could create a separate

minidimension for a package of demographic attributes, such as age, gender,

number of children, and income level, presuming that these columns get used

extensively. There would be one row in this minidimension for each unique

combination of age, gender, number of children, and income level encountered

in the data, not one row per customer. These columns are the ones that

are analyzed to select an interesting subset of the customer base. In addition,

users want to track changes to these attributes. We leave behind more constant

or less frequently queried attributes in the original huge customer table.

Sample rows for a demographic minidimension are illustrated in Table 6.3.

When creating the minidimension, continuously variable attributes, such as

income and total purchases, should be converted to banded ranges. In other

words, we force the attributes in the minidimension to take on a relatively small

number of discrete values. Although this restricts use to a set of predefined

bands, it drastically reduces the number of combinations in the minidimension.

If we stored income at a specific dollar and cents value in the minidimension,

when combined with the other demographic attributes, we could end up with as

many rows in the minidimension as in the main customer dimension itself. The

use of band ranges is probably the most significant compromise associated

with the minidimension technique because once we decide on the value bands,

it is quite impractical to change to a different set of bands at a later time. If users

insist on access to a specific raw data value, such as a credit bureau score that is

updated monthly, it also should be included in the fact table, in addition to

being represented as a value band in the demographic minidimension.

Values are available in mididimension as well as in fact

Every time we build a fact table row, we include two foreign keys related to the

customer: the regular customer dimension key and the minidimension demographics

key. As shown in Figure 6.4, the demographics key should be part of

the fact table’s set of foreign keys in order to provide efficient access to the fact

table through the demographics attributes. This design delivers browsing and

constraining performance benefits by providing a smaller point of entry to the

facts. Queries can avoid the huge customer dimension table altogether unless

attributes from that table are constrained.

When the demographics key participates as a foreign key in the fact table,

another benefit is that the fact table serves to capture the demographic profile

changes. Let’s presume that we are loading data into a periodic snapshot fact

table on a monthly basis. Referring back to our sample demographic minidimension

sample rows in Table 6.3, if one of our customers, John Smith, was 24

years old with an income of $24,000, we’d begin by assigning demographics

key 2 when loading the fact table. If John has a birthday several weeks later,

we’d assign demographics key 18 when the fact table was next loaded. The

demographics key on the earlier fact table rows for John would not be

changed. In this manner, the fact table tracks the age change. We’d continue to

assign demographics key 18 when the fact table is loaded until there’s another

change in John’s demographic profile. If John receives a raise to $26,000 several

months later, a new demographics key would be reflected in the next fact

table load. Again, the earlier rows would be unchanged. Historical demographic

profiles for each customer can be constructed at any time by referring

to the fact table and picking up the simultaneous customer key and its contemporary

demographics key, which in general will be different from the most

recent demographics key.

The minidimension terminology refers to when the demographics key is part of the

fact table composite key; if the demographics key is a foreign key in the customer dimension,

we refer to it as an outrigger.

The best approach for efficiently browsing and tracking changes of key attributes in

really huge dimensions is to break off one or more minidimensions from the dimension

table, each consisting of small clumps of attributes that have been administered

to have a limited number of values.

Variable-Width Attribute Set

When using external prospect lists, we often are permitted only a one-time use

of the list and don’t have the legal right to store the prospect information internally.

However, if we’ve generated our own prospect information, it certainly

can be stored in the data warehouse. Let’s assume that we’re capturing metrics,

perhaps associated with solicitation or quote-generation events that apply to

both prospects and customers. We could store the prospects and customers

together in a single contact dimension; however, there is a significant disparity

between the numbers of attributes for prospective versus customer contacts. As

illustrated in Figure 6.6, we may know only a handful of identification and location

attributes about our prospects. On the other hand, we may know 50 additional

attributes for a customer, covering purchase, payment, credit and service

behaviors, directly elicited profile attributes, and third-party purchased demographic

attributes. In the world of electronic retailing, we can equate prospects

to be the anonymous Web site visitors as opposed to our registered customers

If we’re dealing with a database platform that supports variable-width rows,

such as Oracle, we may be able to build a single dimension with the full complement

of attributes if the total attributes list is not too long; in some of these

cases, we don’t need to worry about all the prospects’ null columns because

they take up virtually zero disk space. However, if we have a fixed-width database,

or if the attributes list is very long, we are uncomfortable with all the

empty columns for the prospects. In this case, as shown in Figure 6.6, we break

the dimension into a 10-million-row base dimension table consisting of attributes

that are common to both prospects and customers, along with a 1-millionrow

customer minidimension that contains the additional attributes we know

about our customers. Again, we include two foreign keys in the fact table.

Nine of ten fact table rows would join to an empty customer row in the

extended customer minidimension.

behaviour customer group

The secret to building complex behavioral study group queries is to capture the keys

of the customers or products whose behavior you are tracking. You then use the captured

keys to constrain other fact tables without having to rerun the original behavior

Variable-Depth Hierarchies

Representing an arbitrary, ragged organization hierarchy is an inherently difficult

task in a relational environment. For example, we may want to report the

revenues for a set of commercial customers who have intricate relationships

with each other, such as in Figure 6.8. Each square on the diagram represents

an individual customer entity connected in an organizational tree. The illustrated

organization has four levels; other customer organizations may have

one, ten, or more levels. Let’s assume that we sell our products or services to

any of these commercial customers. Thus the customer dimension rows can

play the role of parent as well as child. We may want to look at the customers

and their sales revenue individually. At other times, we may want to summarize

revenue to any node in the overall organizational tree.